Best budgeting apps

Managing personal finances can often feel like a daunting task. As a result, many people neglect to keep track of their expenses and budget. However, with the rise of user-friendly budgeting apps, this process has become easier than ever.

In this article, we’ll explore some of the best budget apps available for Mac and iOS to help you take control of your financial well-being.

What are budgeting apps?

Before we dive into reviewing the best budgeting tools, let’s take a moment to understand what these apps are and how they work.

Budget apps are software designed to help individuals effectively manage their personal finances.

A budgeting app typically presents an organized dashboard that provides a snapshot of your financial status. It may include charts or graphs that visually represent your income, expenses, and savings.

What does a budgeting app do?

Budget software allows users to create budgets, set financial goals, and monitor their spending habits. In addition, it often offers features such as bill payment reminders, automated transaction imports, and detailed reporting and analysis.

When choosing a budgeting app, it’s essential to consider a few key features.

Look for budget tools that offer effortless expense tracking, customizable budget categories, automatic transaction import, robust reporting features, and the ability to sync across multiple devices. In addition, consider your specific needs, such as the need for bill reminders, goal setting, or investment tracking.

What is the best budgeting app?

- YNAB for practical zero-based budgeting

- Chronicle for tracking your income, expenses, and bills

- Expenses for efficient budgeting and financial tracking

- GreenBooks for understanding your finances through intuitive charts

- Receipts for receipt management and financial control

- UctoX for editing and tracking your invoices

- Goodbudget for the tried-and-true envelope budgeting

- Mint for finance management at no cost

- MoneyWiz 2023 for budgeting the way that works for you

YNAB for practical zero-based budgeting

Why you might like it: This app is designed to help users plan ahead for their financial decisions rather than tracking past transactions. YNAB follows the zero-based budgeting system, which requires you to make a plan for every dollar you earn.

As soon as you get paid, you tell YNAB how much of your income should go to different categories, including expenses, goals, and savings. YNAB’s philosophy is that you’ll be more conscious of your money when you are asked to actively decide what to do with it.

With YNAB, you can link together your checking and savings accounts, as well as your credit cards and loans. The app works on the web, your iPhone, iPad, and Apple Watch.

Why you might not like it: You have to be committed to keeping up with YNAB. It’s designed to work best for users who want to get hands-on while planning their money. It’s also pricey compared to some of the other apps we’ve listed below.

Price: $14.99/month or $99/year.

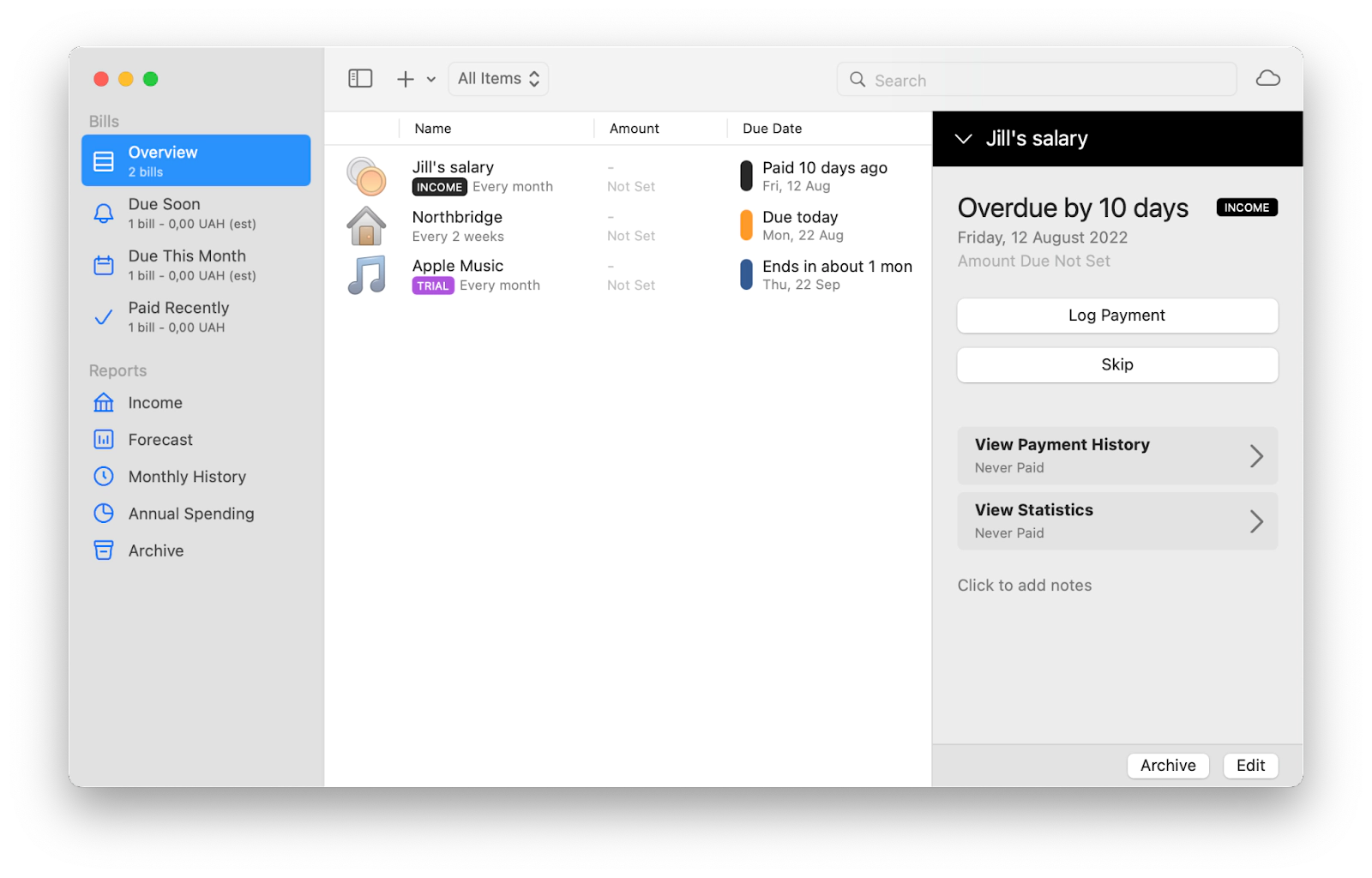

Chronicle for tracking your income, expenses, and bills

Why you might like it: Have you ever struggled to keep track of your bills? Have you ever missed a payment, and it ended up hurting your credit score?

Chronicle focuses on tracking your bills and when they are due. With it, you can get notifications when there’s a bill waiting to be paid.

If you include a payment URL when you create a new bill entry, you can use it to go directly to the website when it’s time to pay the bill. This is especially convenient because everything you need to complete the process is in one place, making it more likely that you’ll complete the payment as soon as you receive the notification.

Chronicle finance app can also help you understand your expenses, where your money is going, and how much you have to pay each month with its data analysis features. Chronicle is available on macOS and iOS.

Why you might not like it: Although we consider Chronicle one of the best personal finance apps on the market, it’s not perfect. You might not like its calendar restrictions. Once you start using the app, you’ll notice a calendar display on the right side of the main interface. It has markers and icons to show when various items are due. The problem is that this calendar isn’t interactive, so even though you can see that something is due on a certain day, you can’t access the item by clicking on that day.

Price: Available on Setapp, a platform with 240+ apps for Mac, iPhone, and iPad. Install as many apps as you want. Pay $9.99 once a month for all. 7-day free trial.

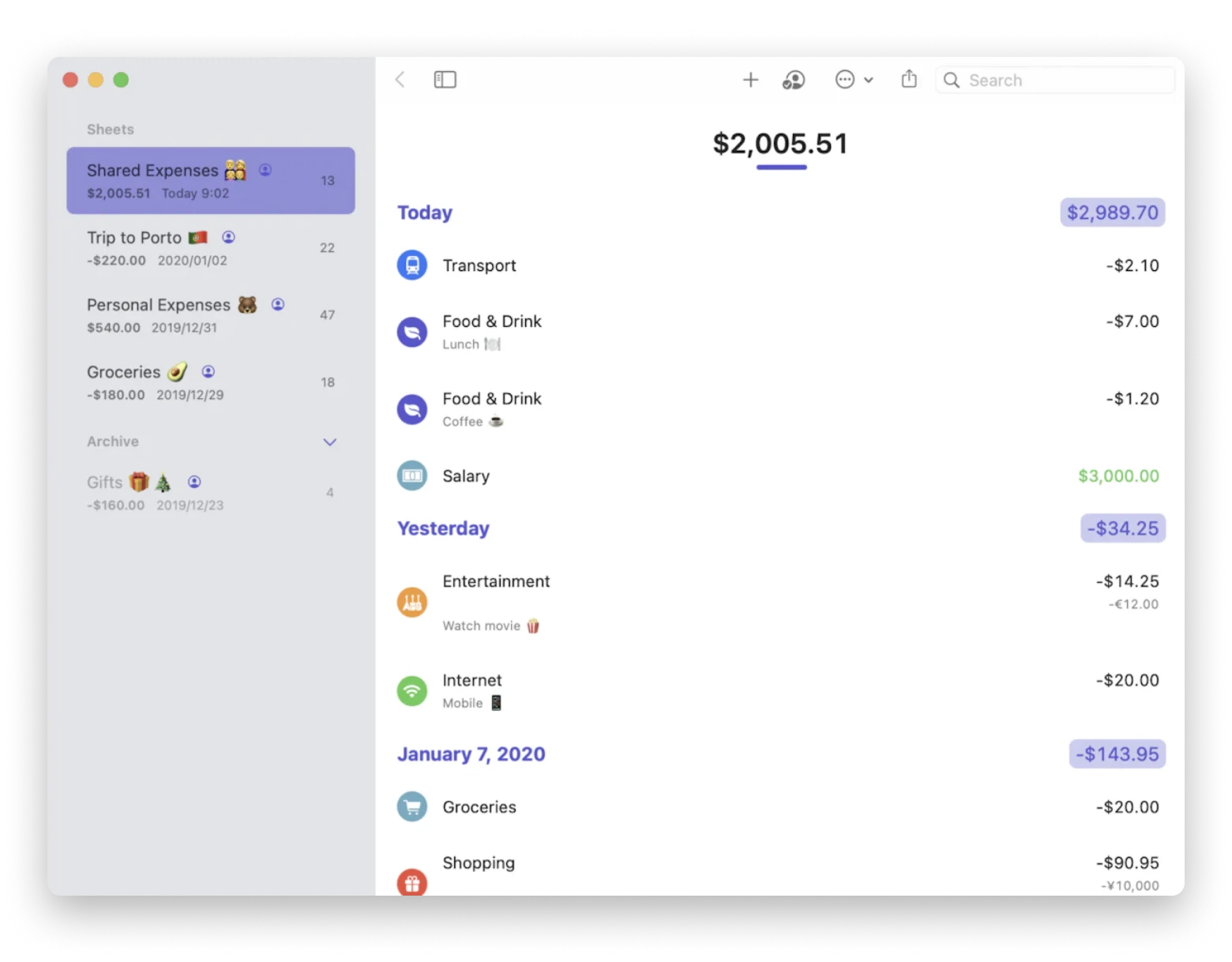

Expenses for effortless budgeting and financial tracking

Why you might like it: Another great budgeting app to try is Expenses. It was designed to make tracking your expenses effortless, with useful features in a simple, intuitive interface. And with iCloud, it’s easy to keep all your expenses in sync across all your devices. You can even collaborate with others using sharing.

What’s more, Expenses is designed to be accessible to everyone, including those with special needs, through built-in accessibility features.

This money managing app supports all the currencies you may need. This is especially helpful when traveling. Expenses also supports automatically updated exchange rates for major currencies.

The app is available for Mac, iPhone, and iPad.

Why you might not like it: The app may lack advanced reporting features for those seeking in-depth financial analysis.

Price: Available on Setapp, a platform with 240+ apps for Mac, iPhone, and iPad. Install as many apps as you want. Pay $9.99 once a month for all. 7-day free trial.

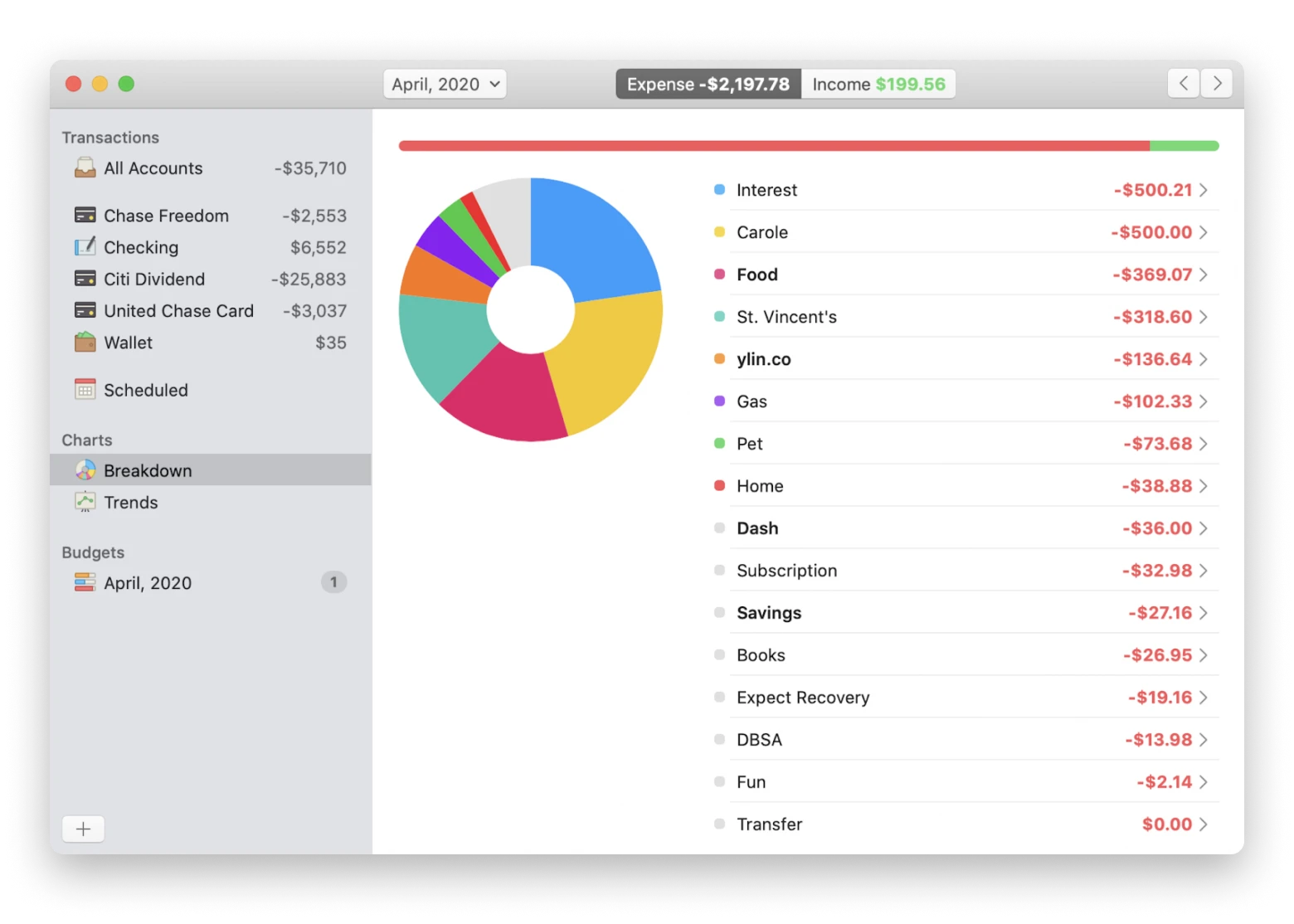

GreenBooks for understanding your finances through intuitive charts

Why you might like it: Unlike many of the typical financial apps you come across, GreenBooks is designed to look and feel simple.

Once you have all of your financial accounts in place, you can have all of your transactions tracked on a regular basis. GreenBooks will then take your provided data and turn it into intuitive charts, trends, and other actionable items.

You can also check out the Direct Connect feature to automatically sync bank account transactions. Have accounts in multiple currencies? Track them all in GreenBooks because the app supports multiple currencies. GreenBooks is available on both macOS and iOS.

Why you might not like it: While GreenBooks offers useful features for basic accounting needs, it may lack the advanced functionality required by those with complex financial requirements.

Price: Available on Setapp, a platform with 240+ apps for Mac, iPhone, and iPad. Install as many apps as you want. Pay $9.99 once a month for all. 7-day free trial.

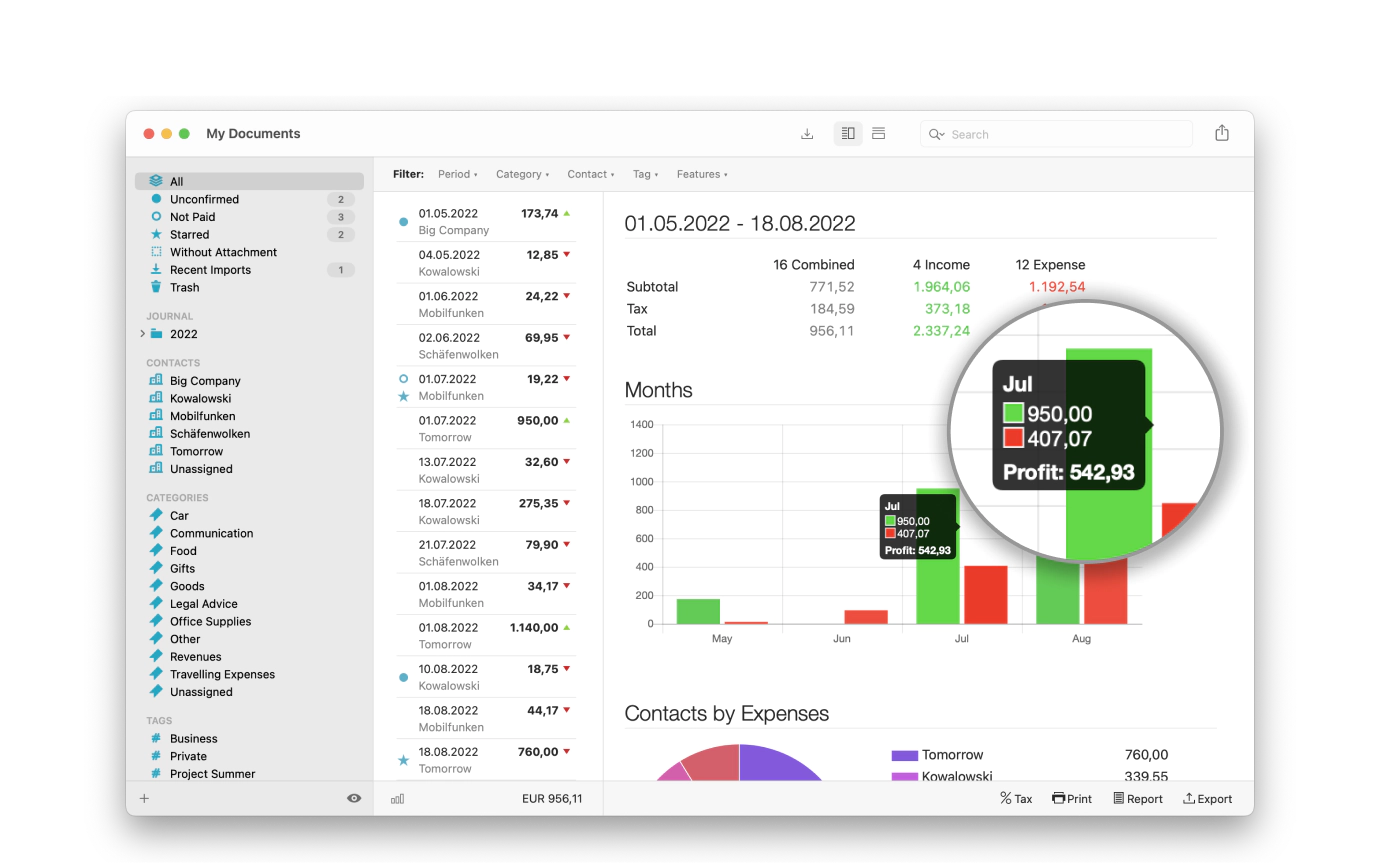

Receipts for receipt management and financial control

Why you might like it: Receipts is a small utility for Mac that helps you scan, track, and manage your bills. Any receipts you import are automatically converted to PDF and carefully stored in the library.

The app reads your documents – whether it’s an image, a PDF, or a web page – and extracts data such as document date, bank details (IBAN), and amount + taxes. It’s all done with minimal effort on your part. That’s why Receipts is a perfect tax preparation software.

Why you might not like it: You might lack spending forecasts. However, for this purpose, you can combine this app with a lightweight bill planner like Chronicle or MoneyWiz.

Price: Available on Setapp, a platform with 240+ apps for Mac, iPhone, and iPad. Install as many apps as you want. Pay $9.99 once a month for all. 7-day free trial.

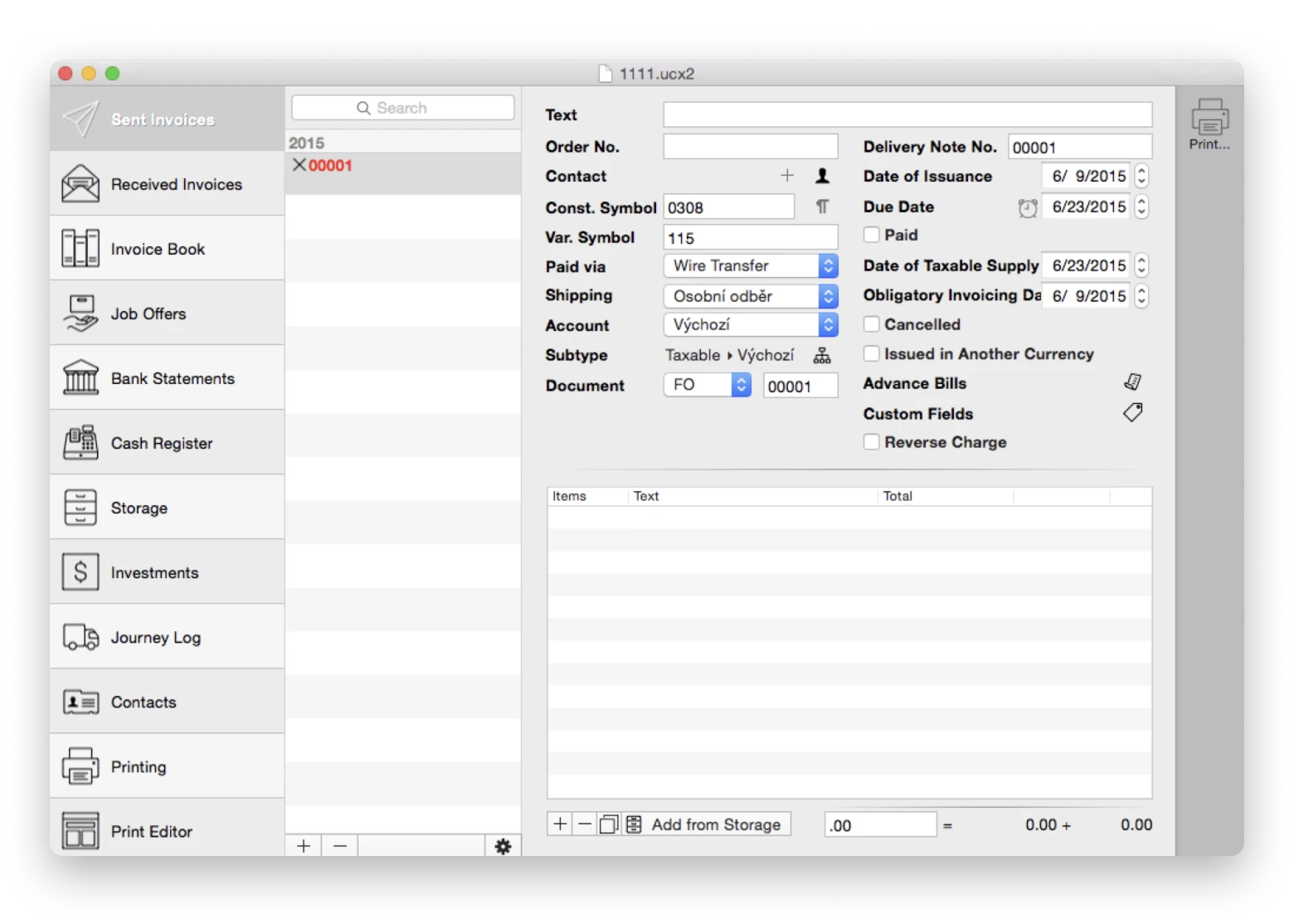

UctoX for editing and tracking your invoices

Why you might not like it: UctoX is an invoicing app that specializes in helping individuals and businesses to create, manage, and send out invoices for the products or services they provide. While it may not have the extensive features of a dedicated budgeting app, it can still play a role in financial management.

Why you might like it: In addition to invoicing, this useful app lets you manage your bank statements, cash register, storage, mileage logs, and more. For added convenience, you can create multiple accounts, then sync them via iCloud so you can access data on all your iOS and Mac devices.

Price: Available on Setapp, a platform with 240+ apps for Mac, iPhone, and iPad. Install as many apps as you want. Pay $9.99 once a month for all. 7-day free trial.

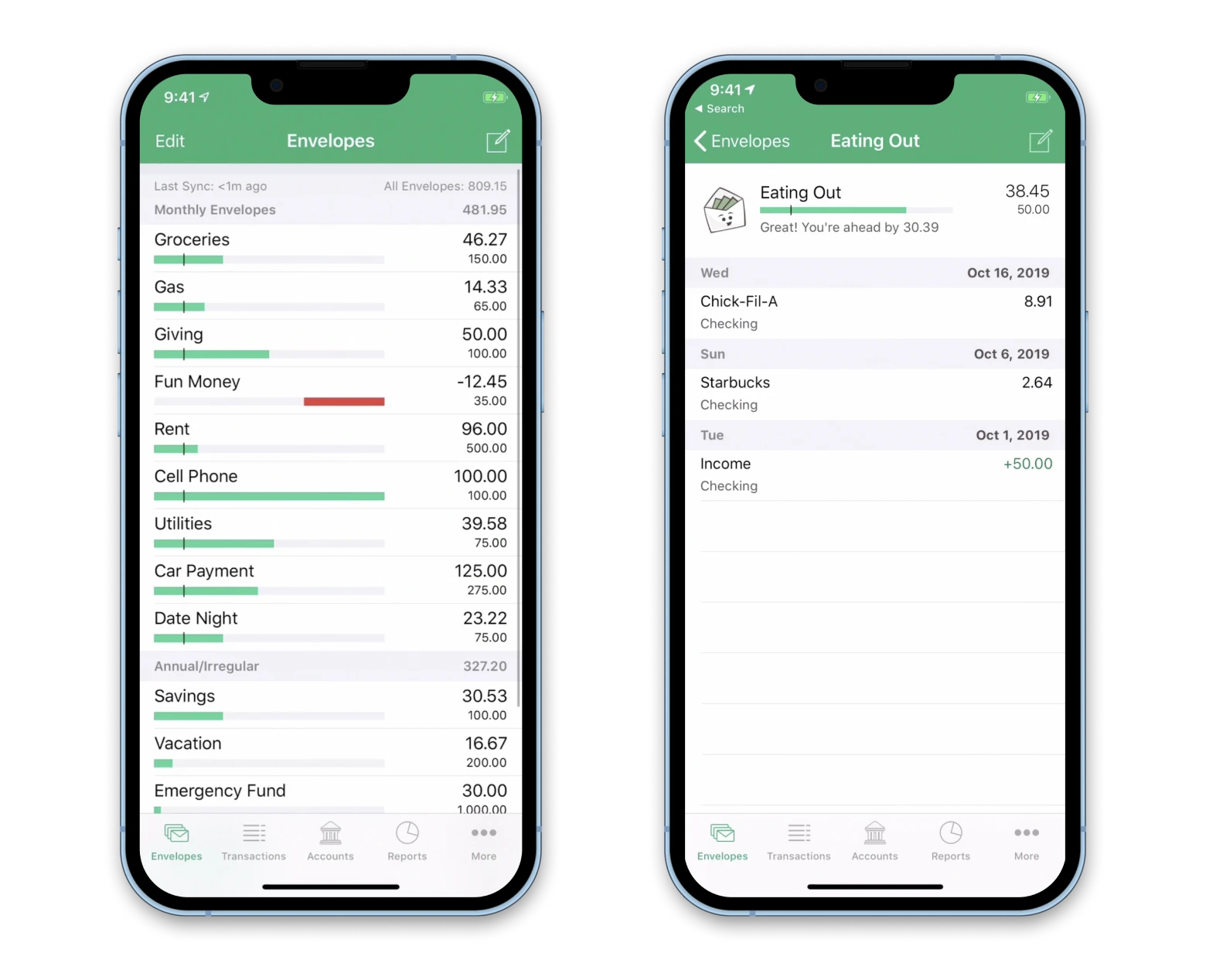

Goodbudget for the tried-and-true envelope budgeting

Why you might like it: Goodbudget is a simple budgeting app that works as a digital envelope system. The envelope system divides your income into specific spending categories, such as rent, groceries, dining out, household purchases, healthcare, and gas. This type of system ensures that you don’t spend more than you make and that you stay within your budget for each category of spending. For many users, this system helps limit impulse purchases.

If you like reports and charts, you’ll love Goodbudget. Its reports give you a clear overview of how you’re spending your money and your progress toward your goals. The reports can also help motivate you to keep going.

Why you might not like it: There is no way to sync your bank account with the app for automatic updates.

Goodbudget offers a free version of their app. However, it has limitations that may require a paid subscription for most people.

Price: Free and $8/month.

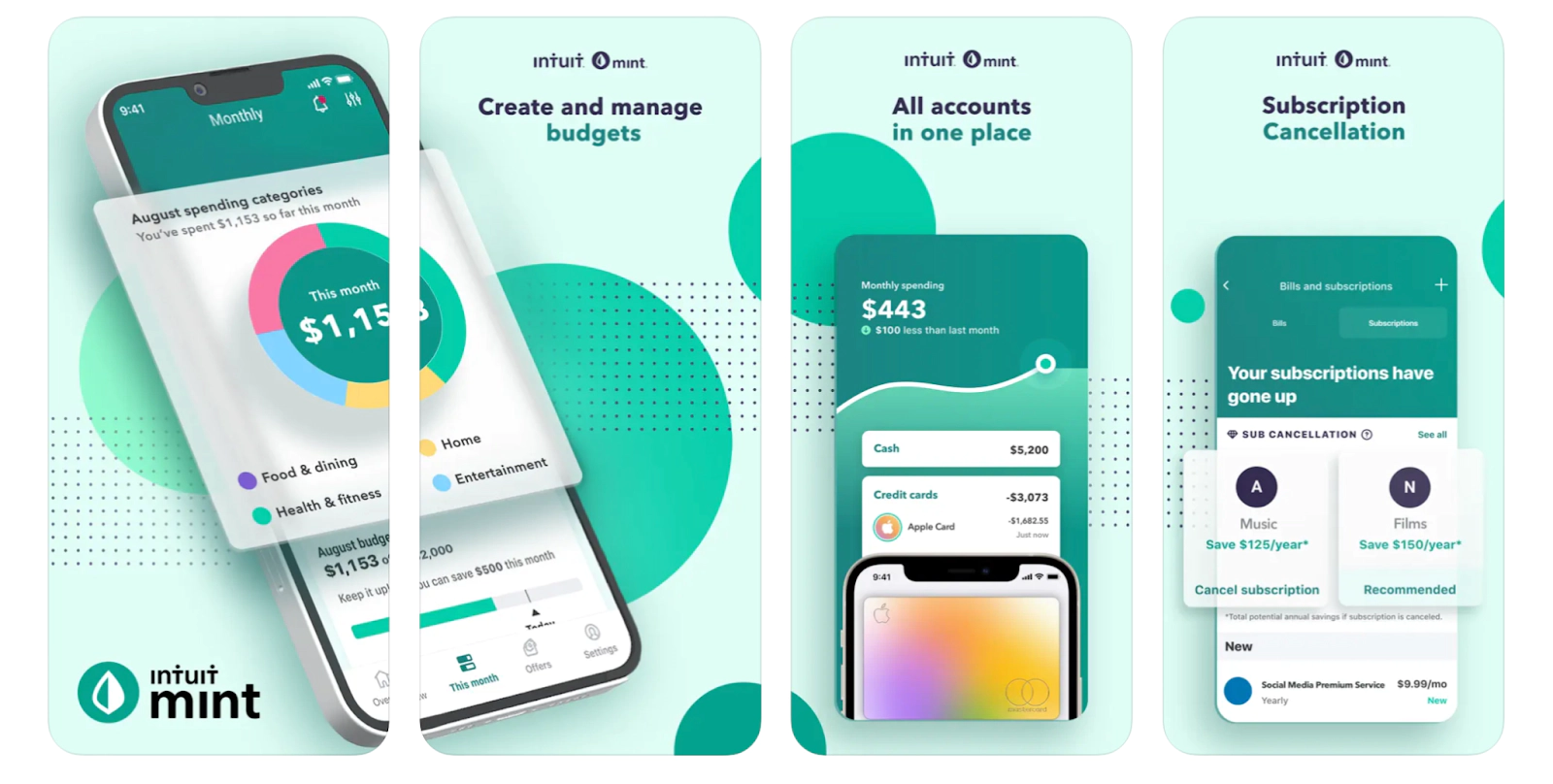

Mint for finance management at no cost

Why you might like it: If you want a free budgeting app with more features than Goodbudget: Mint does more.

With Mint, you can set bill reminders and receive alerts when you go over your budget, incur a late fee, or have an upcoming bill due. You can set financial goals and track your progress. It’s also possible to sync your financial accounts to reduce manual work.

If you’re wondering if it’s safe to use a free budget app, remember that the app developer uses VeriSign for secure data transfer and multi-factor authentication to protect your account.

Why you might not like it: Speaking of drawbacks, sometimes Mint will automatically assign expenses to the wrong category. If a mistake is made, you can edit the categories, but this requires extra effort.

Mint occasionally has trouble connecting to a specific financial account. In particular, users have had difficulty successfully adding accounts from smaller institutions.

Price: Free.

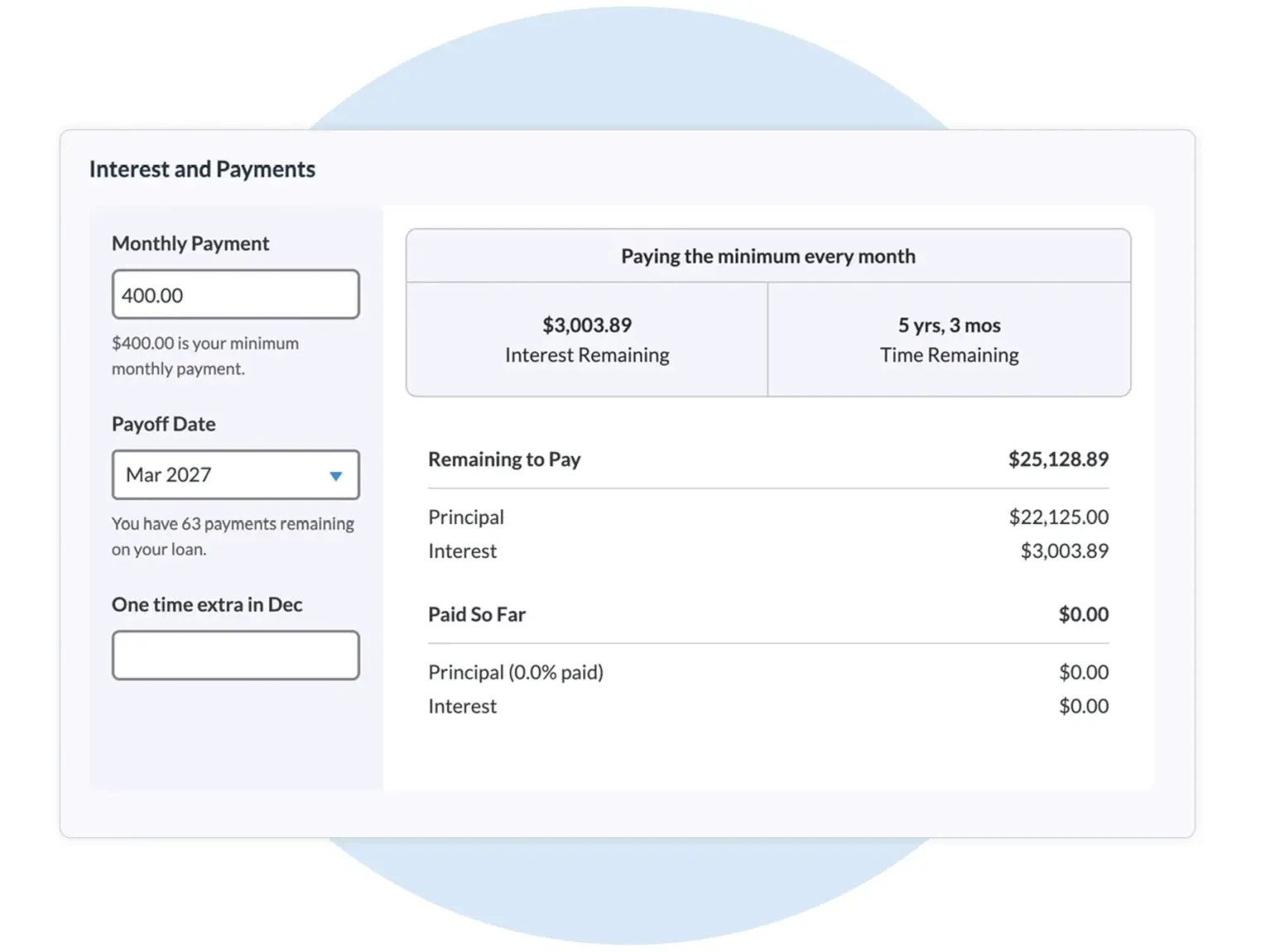

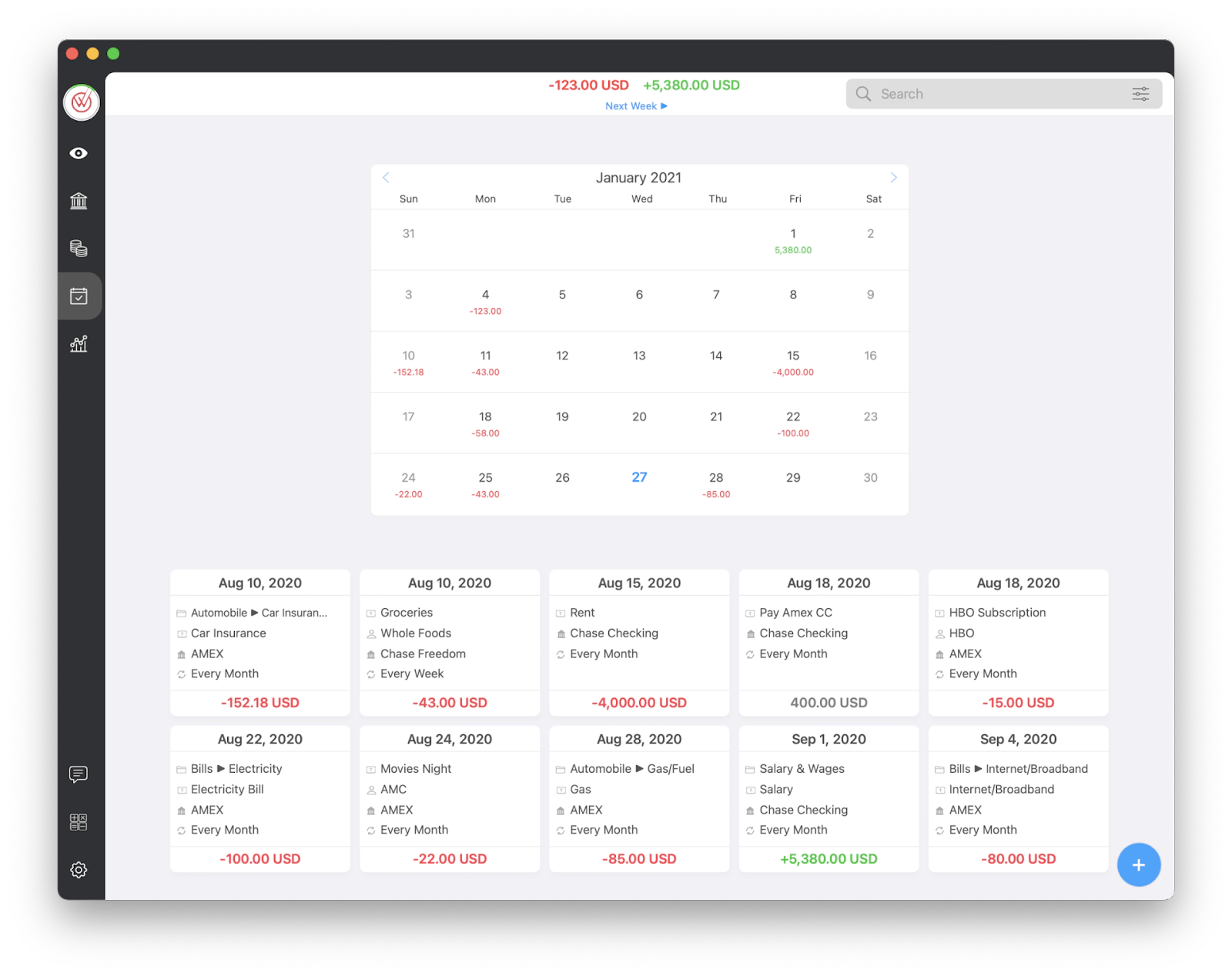

MoneyWiz 2023 for budgeting the way that works for you

MoneyWiz 2023 is packed with features for the professional user, yet it’s easy to use for the beginner. It doesn’t tell you how to manage your money but is versatile enough to allow you to manage it the way that makes sense to you.

Being one of the best finance apps, MoneyWiz offers both income and expense-based budgets with automatic detection of new transactions based on categories or tags. You can easily rebalance budgets anytime by moving money from one to another. See exactly where you are versus where you should be with the built-in budget progress view.

The app works offline and automatically syncs when you are online.

Price: Available on Setapp, a platform with 240+ apps for Mac, iPhone, and iPad. Install as many apps as you want. Pay $9.99 once a month for all. 7-day free trial.

How to choose the best personal budget software?

When choosing the best budgeting app, it’s important to look for certain features that can make a big difference in effectively managing your finances. Features such as effortless expense tracking, customizable budget categories, automatic transaction import, robust reporting capabilities, and multi-device syncing should be on your radar.

While reading about these features is helpful, the best way to determine which app is right for you is to try it out for yourself. Fortunately, many of the apps mentioned in this article, including Chronicle, Expenses, GreenBooks, Receipts, UctoX, and MoneyWiz 2023, are available for a free trial on Setapp. By exploring these tools for yourself, you can make an informed decision and find the perfect budgeting solution that aligns with your financial goals.

In addition, Setapp offers a wide selection of other fantastic web, Mac, iPhone, and iPad apps for various purposes, making it a comprehensive platform to enhance your digital experience.

If you’re not a member yet, head over to Setapp for a free 7-day trial!

| Name | The best app’s feature | Price | Available on |

|---|---|---|---|

| YNAB | "Zero-based budgeting" approach | $14.99/mo or $99/year | web and iOS |

| Chronicle | "Bill management and reminders" functionality | $9.99/mo for Chronicle + 240+ Mac and iOS apps | macOS and iOS |

| Expenses | "Expense tracking and categorization" capability | $9.99/mo for Expenses + 240+ Mac and iOS apps | macOS and iOS |

| GreenBooks | Intuitive charts | $9.99/mo for GreenBooks + 240+ Mac and iOS apps | macOS and iOS |

| Receipts | Receipt management / tax preparation | $9.99/mo for Receipts + 240+ Mac and iOS apps | macOS |

| UctoX | Comprehensive invoicing capabilities | $9.99/mo for UctoX + 240+ Mac and iOS apps | macOS |

| Goodbudget | Virtual envelopes for different spending categories | Free and $8/mo | macOS and iOS |

| Mint | Bill reminders | Free | iOS |

| MoneyWiz 2023 | Robust and customizable financial tracking and reporting capabilities | $9.99/mo for MoneyWiz + 240+ Mac and iOS apps | macOS and iOS |